Update on Market Volatility and Bond Holdings

We are writing to provide an update and our view on the recent volatility in both the equity and fixed income markets this year. More specifically, year-to-date as of May 9th, the S&P 500 Index is down 15.85% and the Bloomberg US Aggregate Bond Index, a measure of the broad US investment-grade bond market, is down 10.11%. Not only are these decreases large, they are also highly unusual when taken together. In fact, the losses in these equity and bond indexes year-to-date represent their largest concurrent drop on record since 1976.¹

Market drawdowns themselves are a normal part of investing, so while unwelcome, declines of the magnitude mentioned above, particularly for stocks, are not atypical. There are two facets that make this 2022 drawdown particularly unique and difficult: (1) because we have, until now, experienced a roughly 40-year decline in US interest rates, high-quality bonds, which tend to go up in value when interest rates decline, have had very few losses of this magnitude in such a short period of time and; (2) as noted above, material drawdowns in both stocks and high-quality bonds concurrently are very uncommon.

For balanced portfolios, the start of this year has been particularly challenging. High-quality bonds historically have provided strong diversification benefits to an equity allocation, acting as a buffer during periods of heightened stock market volatility. Though we expect this relationship to continue to hold well into the future, unfortunately this year (thus far) bonds have not provided such protection.

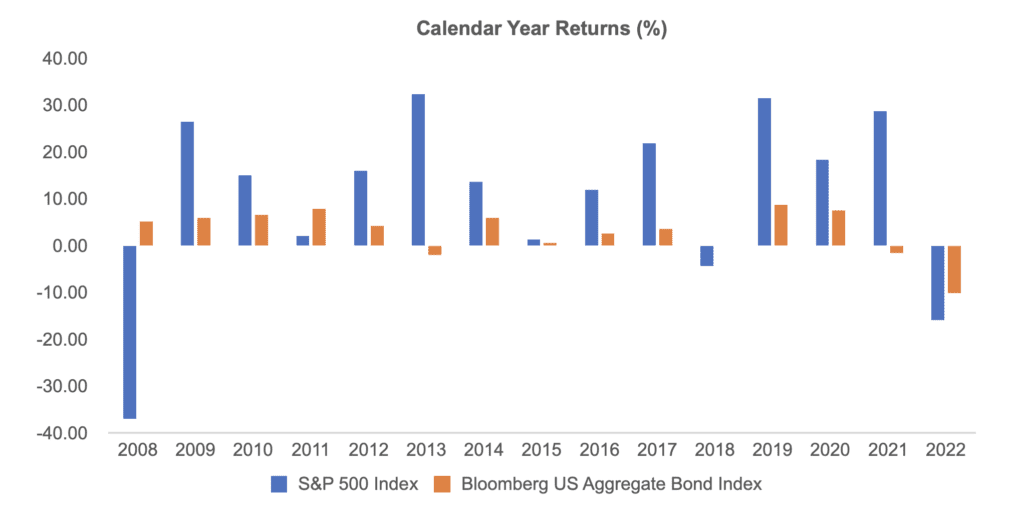

Though we acknowledge the challenging nature of this investment climate, there are a few points of context that we would like to share. First, it is important to remember that the decade following the Global Financial Crisis of 2008-2009 generally provided returns well above historical averages for stocks, the growth engine of our portfolios, and positive returns for bonds. With this point in mind, the recent bouts of volatility may seem less unexpected. Refer to the figure below, which shows calendar-year equity returns (in blue) and fixed income returns (in orange).

Notes: The data above is from Morningstar. The 2022 return is as of 5/9/2022.

Second, regarding fixed income, the vast majority of a bond allocation’s total return is derived from coupon income and subsequent reinvestment of such income (rather than the capital return associated with rising or falling prices). The sharp rise in yields today, while certainly painful in the short-term, creates better return prospects for the future by boosting bonds’ potential income return, particularly for investors with a longer investment horizon.² For example, looking at US government bond yields, the 10-year US Treasury yield essentially doubled from approximately 1.6% at the beginning of 2022 to close to 3.1% as of May 6th.

There is a significant amount of uncertainty in the world today. Inflation readings remain elevated in the US, the conflict in Ukraine is becoming increasingly protracted, and the Federal Reserve is embarking on a monetary policy tightening cycle. PMA is closely following all of these events and will continue to keep you updated. With that being said, as always, it is extremely important to stay the course regarding your investment plan. Focusing on the long-term helps in tuning out the unsettling short-term noise in the markets.

Finally, we want to emphasize that we believe it is likely that this tough stretch in the markets will be an outlier in that both equity and fixed income returns have declined so quickly together. It does feel like we have experienced a steady stream of problems that result in volatility of late, but in these types of periods, it’s important to take a broader perspective. Ben Carlson sums it up best with this comment about the S&P 500 Index’s long-term growth: “The long-term trend in the stock market has historically been up and to the right”—even with myriad bumps along the way—and the long term investor must be prepared to weather these storms to benefit from this trend.³

If you would like to discuss any of the above with your advisor, please do not hesitate to reach out.

¹ See the following article from the Wall Street Journal for additional information. https://www.wsj.com/articles/stocks-and-bonds-are-falling-in-lockstep-at-pace-unseen-in-decades-11651551170?mod=markets_lead_pos5.

² Note that PMA has focused on keeping a shorter-maturity fixed income profile lately in many of our fixed income portfolios to mitigate both rising inflation and interest rate risk.

³ See: https://awealthofcommonsense.com/2022/05/why-does-the-stock-market-go-up-over-the-long-term/.