The Markets Year-to-Date: Uncertainty Abound

This has been a particularly painful year to be invested in the markets. In fact, if the year were to end today, it would constitute the worst annual return for the markets since 2008 and, indeed, measured by the S&P 500, the third worst year for equities since 1975. Most unfortunately, not only has 2022 been a very difficult year for equities, it has also been the worst year in at least fifty years for the bond markets, which have been hammered by the dual impact of rising inflation and rising interest rates. It has been some time since investors have experienced the type of pain which stocks and bonds have simultaneously inflicted this year.

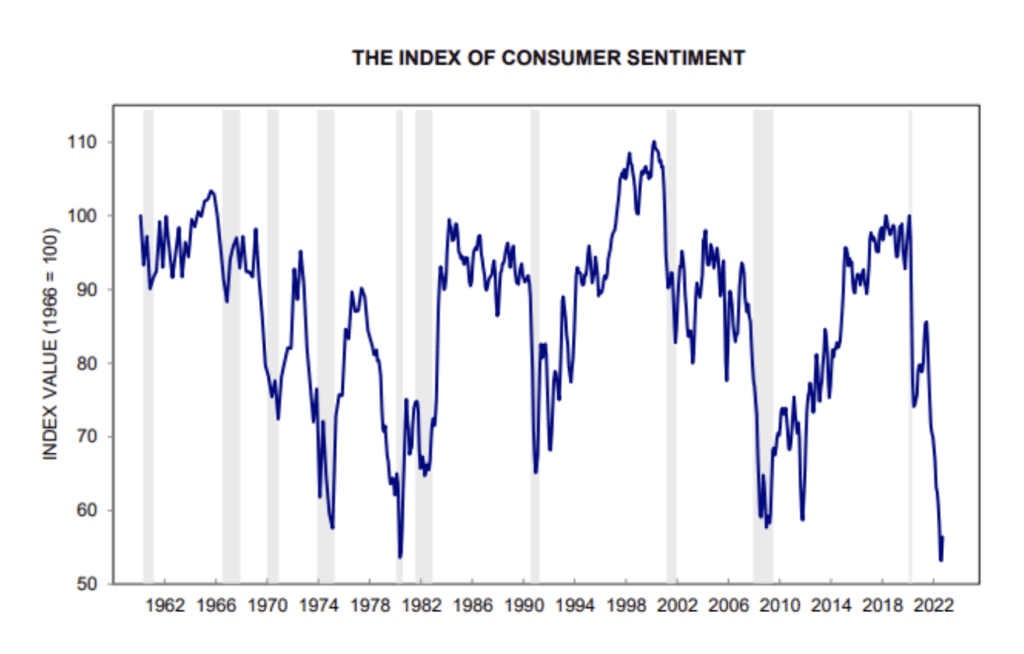

In short, the mood in the financial markets is gloomy. For example, consumer sentiment, measured by a widely cited survey from the University of Michigan, is near all-time lows. Not coincidentally, the last time sentiment reached similar levels in the US via this survey was during the last episode of comparably high inflation—the late 1970s and early 1980s. As we write this commentary, the Federal Reserve announced that it will be lifting its short-term interest rate target by another 75 bps to combat inflation (to a target range between 300 and 325 bps). The Fed has been increasing rates at the fastest clip since the 1980s and has raised rates to the highest level we have seen since 2008.

This year we have witnessed a variety of challenges that have stressed markets, and more specifically, a set of challenges that lack meaningful clarity. Our country, and others around the globe, are currently living through the highest inflation we have experienced in four decades. Here in the US, the Federal Reserve is embarking on an unprecedented monetary tightening cycle by implementing interest rate hikes while unwinding its massive balance sheet (which substantially increased as a result of 2020 pandemic stimulus measures). The war between Russia and Ukraine has taken several unexpected turns, with seemingly no end in sight—and the potential for a more catastrophic disaster looms as Russia prepares to annex Ukrainian territory through dubious referendums and to then claim that any further Ukrainian military advances constitute an attack on Russia itself.

Dealing with this amount of uncertainty is difficult, but the most important action we recommend is to stay the course with your investment plan. Obviously, if your unique circumstances have changed, adjustments certainly should be discussed with your advisor. It is also important to keep in mind a few key points:

1. This gloomy sentiment will not be permanent.

Though it feels like we are in for a protracted period of pessimism, history suggests caution before we fall into despair. Refer to the figure below, which reflects survey data from the University of Michigan’s Consumer Sentiment Index (referenced above). Note that lower values in the figure reflect worse sentiment, as measured by the Survey. As occurred after our last period of protracted inflation in the early 1980s, we expect broad sentiment about our economic prospects to recover as we find resolutions to some of the challenges and uncertainty we are dealing with.

Notes: This figure reflects data from the University of Michigan’s Survey of Consumers.

For additional detail, see: http://www.sca.isr.umich.edu/.

2. Expectations for high and protracted inflation are not currently entrenched, distinct from the environment in the late 1970s.

In fact, much of the selling pressure that we have been experiencing in the stock market over the last few months is a result of the market’s overly optimistic projections for inflation levels. Even as of today, various market indicators such as breakeven inflation rates (the differences in yields between nominal Treasury and TIPS bonds) still predict that inflation will moderate fairly quickly. The Fed also expects broad inflation pressures to fall throughout 2022 and into 2023—more specifically, median projections from their latest forecast for core inflation (which excludes more volatile food and energy categories) are for the rate to reach 4.5% by the end of 2022 and 3.1% by the end of 2023.1 Note that these inflation projections are for the Fed’s preferred inflation measure, the Personal Consumption Expenditures Price Index (or PCE, not the CPI). See: https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20220921.htm. This is critically important, as the public’s inflation expectations are a key driver of how inflation actually unfolds.

3. This is not the first, nor the last, challenging set of market circumstances that we will experience, and the markets continue to march ever higher over the long-term.

Bumpiness in the markets like we are currently experiencing is an unfortunate part of long-term investing. We do not expect the next year to be easy, but we do expect our country (and the financial markets) to move through these crises as we have throughout our history. For example, despite the declines in the S&P 500 and the Dow Jones Industrial Average this year, both indexes are still well above the point they were at on February 21, 2020, which is just before the impact of the pandemic and the attendant shutdowns that caused a precipitous decline. And, of course, since the beginning of 2009 through August 2022, the S&P 500 has generated cumulative returns of 476% while the DJIA returned 404%. Furthermore, while the increase in interest rates has impacted the market value of bonds, higher rates have also now increased the future yield available to patient investors.

PMA has of course been monitoring all of these events carefully, and has made changes in our clients’ portfolios this year as circumstances warrant. Among other actions, PMA has boosted our allocation to TIPS bonds (introduced in 2021) and shortened the maturity profile of our fixed income portfolios to protect against rising interest rate and inflation risk. We also modestly boosted our allocation to value stocks on the belief that value equities are better positioned for an environment of higher interest rates and inflation (amongst other reasons). We will continue to monitor the markets and make any adjustments that our Investment Committee believes necessary in our clients’ portfolios. But, most fundamentally, to quote Charlie Munger, as we have in similar circumstances in the past, being able to “react with equanimity” to large market declines is “in the nature of long-term shareholding.” These words may be “easier said than done” but rising to the challenge they represent is, in our opinion, critical during times such as these.