An Update from the PMA Investment Committee: Market Volatility and Portfolio Rebalancing

“Talking about being a long term investor during a bull market is practice. Behaving like a long term investor during a bear market is the game.”

Financial Writer Michael Batnick

We begin this special note with the above quote because it sums up succinctly PMA’s view now that the longest bull market in history has ended, and given that on March 12 the markets experienced their worst daily performance since 1987, thirty-three years ago. The idea that markets could continue on an upward trajectory forever was, needless to say, a fantasy, and though what we are experiencing with the coronavirus now feels more like a nightmare, PMA’s view remains that investing is a long term endeavor and that, as such, now is not the time to change strategies that are based on long term principles.

To put it another way, in words used many times by PMA Founder Ed Snitzer, the long term bet made by PMA is, ultimately, on America itself, and that if America fails, there will be no other markets in which to take recourse.

Legendary investor Warren Buffett in his February 2019 letter to his shareholders similarly attempted to provide long term perspective by reminding his readers of many of the travails the country has faced in the past: “Since 1942 . . . the country contended at various times with a long period of viral inflation, a 21% prime rate, several controversial and costly wars, the resignation of a president, a pervasive collapse in home values, a paralyzing financial panic and a host of other problems. All engendered scary headlines; all are now history. . .” Just this week in an interview Buffett stated about this latest sell-off that although “it may have taken me to 89 years of age to throw . . . [a pandemic into my] experience”, even so the Global Financial Crisis of 2008-2009 when “everything had come to a stop” was “much more scary, by far, than anything that happened yesterday.”

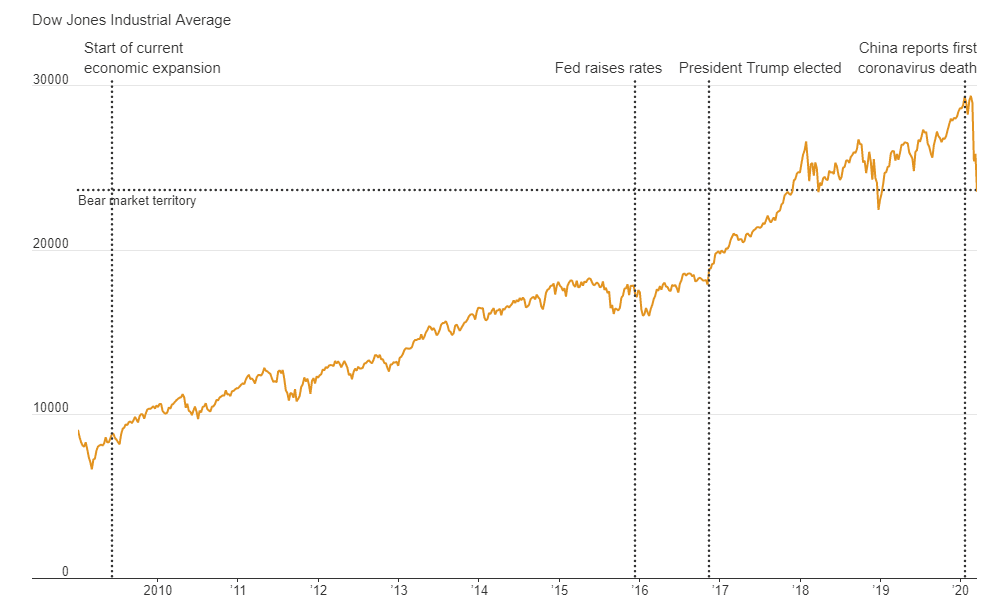

With respect to the Global Financial Crisis of 2008-2009, during which the Dow Jones declined at its bottom by 52 percent, the below chart shows the performance of this index from 2009 up through March 11, 2020:

Of course none of this is to say that the performance of the markets this month has been anything other than upsetting, bringing to mind another old saying or joke – that the job of a pilot and an investor are defined by “years of boredom punctuated by moments of terror.” The investor, however, has something critical that the pilot lacks – a moment of time to catch his or her breath and to remember his/her long term goals. Accordingly, selling out of the stock market during these periods of volatility and moving exclusively into cash or bonds is a type of “market timing” effort that is not the recommended strategy. Those who followed such a strategy during the market turmoil in 2008-2009 missed the subsequent significant recovery reflected in the chart above.

The PMA Investment Committee met on March 11, 2020 in an off-cycle meeting to discuss the current macroeconomic situation. The Committee agrees with the sentiments expressed above about continuing to follow long term principles. Accordingly, most of the discussion centered around portfolio rebalancing strategy. In short, with the market decline continuing relatively unabated, many PMA portfolios were pushed outside of the target ranges for our Small Risk, Moderate Risk, and Substantial Risk portfolios. The committee concluded that PMA, following its investment discipline, should rebalance these portfolios back to the intended stock/bond split over the ensuing days. For all clients who have provided alternative standing instructions related to rebalancing, these instructions will be followed. Of course, before any rebalancing action is taken in taxable portfolios, PMA’s advisers carefully balance incurring tax costs when selling (where relevant) with maintaining the portfolio’s target risk profile. This decision involves some degree of subjectivity.

Finally, PMA wants our clients to be aware that we have prepared for any dislocation that may be required as a result of remediation measures taken in light of the coronavirus outbreak. We are currently operating without any interruptions and have not been directly affected by the coronavirus. We have a strong infrastructure in place to support our business continuity efforts. Many PMA employees have remote access which allows them to work from home and PMA also has a secondary site available to it in Ardmore Pennsylvania if for any reason access to our building at 1735 Market Street is disrupted (although many extra measures are being undertaken by the building’s management to ensure that it remains clean and disinfected in common areas).

If you have any questions about any of these matters please do not hesitate to contact us.