Market Outlook

Financial markets have been in a state of turmoil as we move through the second half of 2025. A key driver has been uncertainty from the volatile tariff policy that has been introduced by President Trump. With ongoing conflicts in Ukraine and in the Middle East, geopolitical concerns also continue to play a role. The combination of tariff uncertainty and geopolitical concerns have induced above average macroeconomic uncertainty. This outcome has led to a somewhat indecisive policy position by the Federal Reserve creating even more volatility.

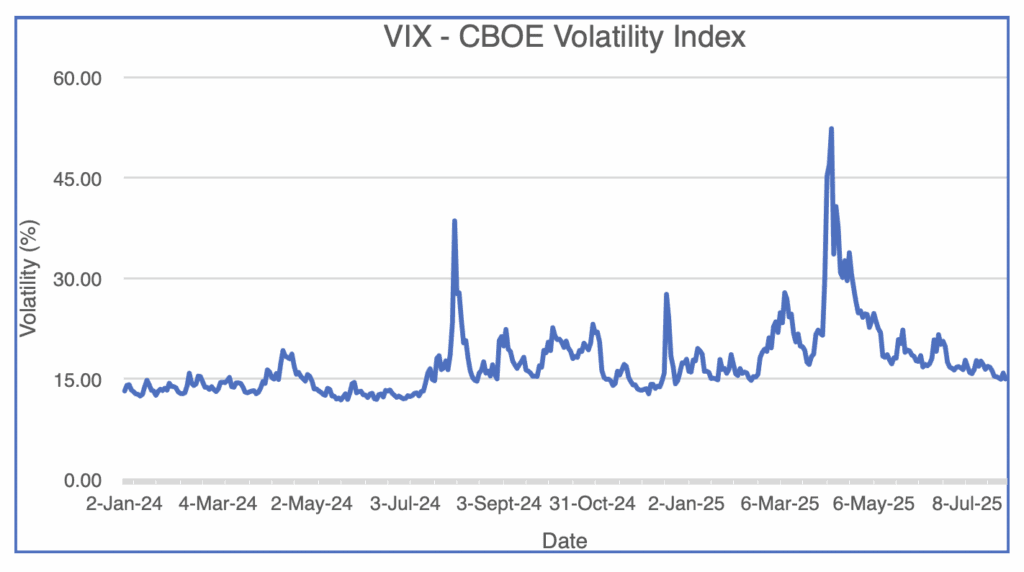

Despite the issues mentioned above, markets have been surprisingly tame. Figure 1 below is a plot of the VIX index1The VIX index is the Chicago Board of Options Exchange (CBOE) volatility index. which is a real-time measure of market uncertainty. The daily volatility measure is plotted from the beginning of January 2024 through the end of July 2025. While there are a few short periods of high volatility, the U.S. market volatility has generally been near 20 percent which represents a normal level. The one recent exception is the high volatility observed in the period following President Trump’s announcement of tariffs on April 2. Despite the recent uncertainty, this volatility measure suggests that the market’s concern with the current environment is lower than one might expect.

The economy has been resilient. The U.S. Bureau of Economic Analysis reported its advance estimate for GDP growth for the second quarter on July 30, 2025. The announced real rate of growth is 3.0 percent. This growth rate represented a bounce-back from a decline of 0.5 percent in the first quarter. However, both The Wall Street Journal and Bloomberg note that this high growth should be interpreted carefully as the rate received a significant boost from a low level of imports in the second quarter. As a result of the threat of tariffs in the second quarter, many companies shifted their orders to the first quarter to avoid possible tariffs. This transfer forward had the effect of increasing second quarter net exports which boosts GDP. Also, focusing on a single quarter can be misleading. If one considers the year-to-date for 2025, the annual growth rate is significantly lower at 1.25 percent. The bottom line is that economic growth has been positive in 2025 but not nearly as strong as a 3 percent quarter suggests.

The Federal Reserve has received a great deal of attention this past quarter (as discussed by Paul Snitzer in last month’s letter). At issue is its independence which except in limited circumstances blocks the president from removing the Chair – Jerome Powell. President Trump is unhappy with Chair Powell and holds him responsible for what he views as a fed funds rate that is too high. (As an aside, it is worth noting that the fed funds rate is set by a vote of the twelve members of the FMOC2Federal Open market Committee. and not solely by the Chair). He would like to appoint a new chair that would lower the fed funds rate. (The rate has not changed since December 2024). Many economists believe that independence of the Federal Reserve is important and argue that the President does not have the right to remove him without good cause prior to the end of his term next May. At this time, it appears that the President will stand down and let Powell complete his term.

The Federal Reserve has received a great deal of attention this past quarter (as discussed by Paul Snitzer in last month’s letter). At issue is its independence which except in limited circumstances blocks the president from removing the Chair – Jerome Powell. President Trump is unhappy with Chair Powell and holds him responsible for what he views as a fed funds rate that is too high. (As an aside, it is worth noting that the fed funds rate is set by a vote of the twelve members of the FMOC2Federal Open market Committee. and not solely by the Chair). He would like to appoint a new chair that would lower the fed funds rate. (The rate has not changed since December 2024). Many economists believe that independence of the Federal Reserve is important and argue that the President does not have the right to remove him without good cause prior to the end of his term next May. At this time, it appears that the President will stand down and let Powell complete his term.

Given this, will the Federal Reserve lower rates this year? With inflation above the Fed’s 2 percent target rate and with unemployment relatively low at 4.2 percent, many feel that a rate cut is not necessary. However, there is not complete agreement. At the Fed’s meeting on July 29 and July 30, two members of the FOMC cast dissenting votes and opposed the Fed’s decision not to lower rates. This number of dissents is unusual. The last time there were two dissents was October 2019. The current consensus view is that if the labor market weakens and inflation stays near the 2 percent target, a cut at either the September meeting or December meeting is likely. One potential source of a softening labor market is business uncertainty resulting from tariffs. The July employment report released on August 1 did show nonfarm payroll growth lower than expected and the unemployment rate increasing to 4.2 percent.

In the stock market today, many valuation measures continue to be high on a historical basis. The current forward price to earnings ratio of the S&P 500 Index is 22.4 compared to the ten-year average of 18.4 (source: FactSet). This relatively elevated ratio implies that stocks are currently priced to reflect a high growth rate of corporate earnings. Current earnings forecasts do reflect solid growth. For calendar years 2025 and 2026, the consensus growth forecasts are 9.6 percent and 13.9 percent (source: FactSet). If these levels of growth are realized, market values should be stable. However, with the current level of uncertainty, the risk of a market decline is higher than normal.

Beyond the current environment, taking a long-term perspective, the projected high level of government debt is a major concern. The Congressional Budget Office (CBO) estimates that the bill recently passed by Congress will increase deficits by more than $3 trillion over the next ten years. Such deficits will lead to very high debt levels relative to GDP and potentially negative consequences for the macroeconomic environment. A high rate of inflation accompanied by a decline in the standard of living are possible. One solution to avoid this outcome is to reduce the budget deficit. Unfortunately, in the current political environment such an outcome seems improbable. In the near term, portfolio adjustments in response to this concern are not justified. But if inflation does start to increase, adding investments that provide a hedge against inflation would be prudent.

In summary, we are in a very uncertain economic environment. The uncertainty is being magnified by current government policy. Monitoring portfolio risk is important as adjustments in response to these policies may be necessary. And, as always is the case, maintaining a diversified portfolio is critical.