Investing in an Uncertain World

Many of us may feel that life is less predictable lately. This feeling rings particularly true as we continue to navigate the aftermath of a once-in-a-century pandemic and an inflation shock the likes of which we have not seen in about 40 years. But more uncertainty, and uncertainty around the markets and economy to be specific, seems to have been seeping into the background for much longer than just a few years.

The concept of “uncertainty” is ambiguous, and therefore quantitatively measuring it is an uncertain process in and of itself. For example, one prominent measure known as the JLN Macro Uncertainty Index tends to spike during periods of market turmoil (i.e., the Global Financial Crisis of 2008-2009), while another published by the International Monetary Fund (IMF) shows that macroeconomic uncertainty peaks more during periods of geopolitical turbulence around the globe. Of course, these two measures are constructed differently which leads to varying results, but they are also interconnected because periods of geopolitical stress often negatively impact the markets, though the relationship isn’t perfect.

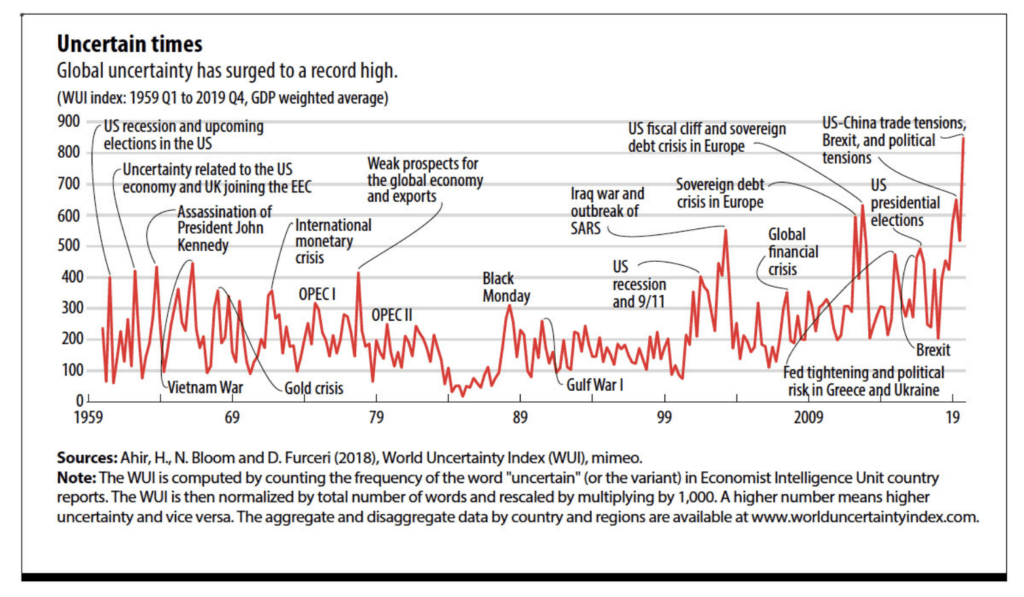

I focus here on the World Uncertainty Index published by the IMF. The IMF’s Index includes over 60 years of data from 143 countries. More specifically, the index “captures uncertainty related to economic and political events, regarding both near-term (e.g., uncertainty created by the United Kingdom’s referendum vote in favor of Brexit) and long-term (e.g., uncertainty engendered by the … withdrawal of international forces in Afghanistan, or tensions between the Democratic People’s Republic of Korea and the Republic of Korea).”160 Years of Uncertainty. Ahir, Bloom, and Furceri. March 2020. The International Monetary Fund. https://www.imf.org/en/Publications/fandd/issues/2020/03/imf-launches-world-uncertainty-index-wui-furceri. The note in the figure provides more detail about the index’s specific construction.

More economic uncertainty within an individual country increases the aggregate level of the Uncertainty Index, so a higher value indicates a more uncertain global climate. In studying the data, the research authors’ conclusion is clear: global uncertainty has materially increased since 2012. As this is a global dataset, the authors largely attribute the Index’s recent upward trend to the rise of globalization in transmitting uncertainty more seamlessly around the world. Note that the data in the figure below only extend through the end of 2019. If we were to update the figure through 2023, the World Uncertainty Index explodes higher in 2020 during the pandemic and then declines to a threshold comparable to pre-pandemic levels in 2023.

Note: Refer to 60 Years of Uncertainty (the same citation as in Footnote 1).

Note: Refer to 60 Years of Uncertainty (the same citation as in Footnote 1).

A more uncertain macroeconomic climate has a few important implications for investors. First, greater uncertainty is typically associated with greater equity market volatility. 2 AQR Capital Management studied the relationship between macroeconomic uncertainty and volatility more closely and found a high correlation between the JLN Macro Uncertainty Index and the CBOE Volatility Index (VIX), amongst other conclusions. Refer to: https://www.aqr.com/Insights/Research/White-Papers/Certainly-Uncertain. From PMA’s perspective, this means that the stock market may very well be a bit choppier over the next few years—2022’s decline and 2023’s market snapback to date are good examples of what higher volatility can look like both on the upside and the downside.

Second, greater equity market volatility increases the importance of portfolio diversification. As PMA clients know, risk control is a core component of our investment philosophy, with diversification being the most effective means of achieving it. Although high-quality bonds did not provide a strong buffer during 2022’s market drawdown due to the unusual interest rate and inflation environment, this painful experience was more of a historic anomaly. We continue to believe that bonds will play a very important role for those that hold balanced portfolios, but even for those who hold portfolios with heavier allocations to equity, the allocations that we build are generally intended to be well-diversified across equity market capitalizations, investment styles, industries, etc.

Finally, and arguably most importantly, greater equity market volatility means following a good investment plan becomes even harder to do. It’s much easier to stick to the script when your monthly statements show steadily rising balances—we know that. Practically speaking, a period of higher market volatility in and of itself does not suggest that an asset allocation change is necessary, but it’s certainly a good time to reassess one’s personal level of comfort with taking risk. This is particularly true for those with large present spending needs relative to the size of a portfolio or with short investment horizons (e.g., withdrawing funds for a child’s college tuition payment in fewer than 3 years).

Uncertainty can be gloomy, but the truth is it is an unavoidable part of life. Geopolitical tensions in the world today, and the macroeconomic risks they bring, do certainly feel elevated. We believe that variables like interest rates and inflation levels around the globe are likely to be less stable in our current environment than they were in the pre-pandemic era. In the short-term, PMA’s Investment Committee adjusts our clients’ portfolio allocations as our views of risk evolve with the changing investment landscape. But with that said, we take comfort in knowing that the markets historically have over the long-term brushed off uncertainty and plowed ever higher.

Looking back to the 2012 inflection point from the IMF’s research, the broad global stock market as measured by the MSCI All Country World Index (Investable Market Index) earned an annualized total return of 9.75% through the end of July 2023. And in all but three of the full calendar years during this period, market returns were positive. Though the future may look very different from the past, a meaningful long-term expected return for investing through uncertainty may help make these types of difficult periods easier to live through.