Inflation Phenomenon

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output… A steady rate of monetary growth at a moderate level can provide a framework under which a country can have little inflation and much growth. It will not produce perfect stability; it will not produce heaven on earth; but it can make an important contribution to a stable economic society.

— Milton Friedman

The summer season is about to start with all of its anticipation of a slowdown to the pace of daily life and the hope of enjoying some rest and relaxation with family and friends. This summer, perhaps, you may also be a bit more anxious than usual about the higher levels of inflation that have continued to persist since 2021 and has seemed to affect the prices of everything, making day to day life much more expensive. While this recent trend of heightened inflation may be cause for concern if it does not moderate, it is also not a reason to abandon a thoughtfully crafted investment plan.

Inflation, a measure of the rate at which prices for goods and services rise, can have significant impacts on the economy and financial markets if it increases at higher than normal levels for a sustained period. From 2021 to 2024, the United States has experienced considerable inflationary pressures, influenced by the aftermath of the COVID-19 pandemic, supply chain disruptions, and expansive fiscal and monetary policies. Historically, moderate inflation is considered a sign of a growing economy, but when inflation rates soar, it can lead to substantial economic disruptions.

One of the most immediate and noticeable effects of inflation during 2021-2024 has been the sharp rise in consumer prices. This has led to a significant erosion of real wages as the purchasing power of income has diminished. In aggregate, prices have surged 20.8% since February 2020, when the COVID-induced recession began, according to the National Bureau of Economic Research. This means that Americans would need about $1,208 to buy the same goods and services that previously cost $1,000. As prices for essential goods and services such as food, housing, and energy have soared, many Americans have found it increasingly difficult to afford their daily needs. Real wages, which account for inflation, stagnated or declined for many, and this decline in purchasing power led to a decrease in overall consumer spending, which is a critical driver of the US economy.

Inflation can also pose significant challenges for businesses. One major issue is the increase in production costs that have resulted from rising prices for raw materials and components due to higher demand and supply chain disruptions. Labor costs have also increased as workers demand higher wages to keep pace with the rising cost of living. These factors combined to squeeze profit margins, particularly for small businesses with limited financial reserves.

Small businesses face additional difficulties in maintaining operations as they struggle to balance rising costs with the need to remain competitive. Passing these costs onto consumers through price increases has been common for many businesses, but this can often lead to reduced consumer demand as consumers become more selective and cut back on non-essential purchases, further impacting business revenues.

The broader economic impact of high inflation from 2021-2024 was marked by slower economic growth. High inflation rates typically lead to slower GDP growth as businesses and consumers alike struggle with rising costs. The Federal Reserve, in response to rising inflation, implemented a series of interest rate hikes to cool down the economy. While these measures were necessary to curb inflation, they also made borrowing more expensive. Higher interest rates discouraged both consumer spending and business investment, contributing to a slowdown in economic activity.

The bond market also reacted to high inflation and rising interest rates. As the Federal Reserve increased rates to combat inflation, bond yields rose, leading to a decline in bond prices. While higher yields on government and corporate bonds made them more attractive relative to the recent past, the increased borrowing costs for businesses issuing new debt also posed challenges, particularly for those with lower credit ratings.

The good news is that despite all of the negative effects of the inflationary environment since 2021, the financial markets, especially the U.S. equity markets, have continued to do well with only one negative year over this period. The S&P 500 was up 28.7% in 2021, down 18.1% in 2022, up 26.3% in 2023 and is up 11.3% through May. This is a good reminder that staying invested, in a diversified portfolio of investments with the appropriate amount of risk for each respective investor, despite whatever the prevailing “bad news” may be, is powerful for wealth creation and preservation over the long-run.

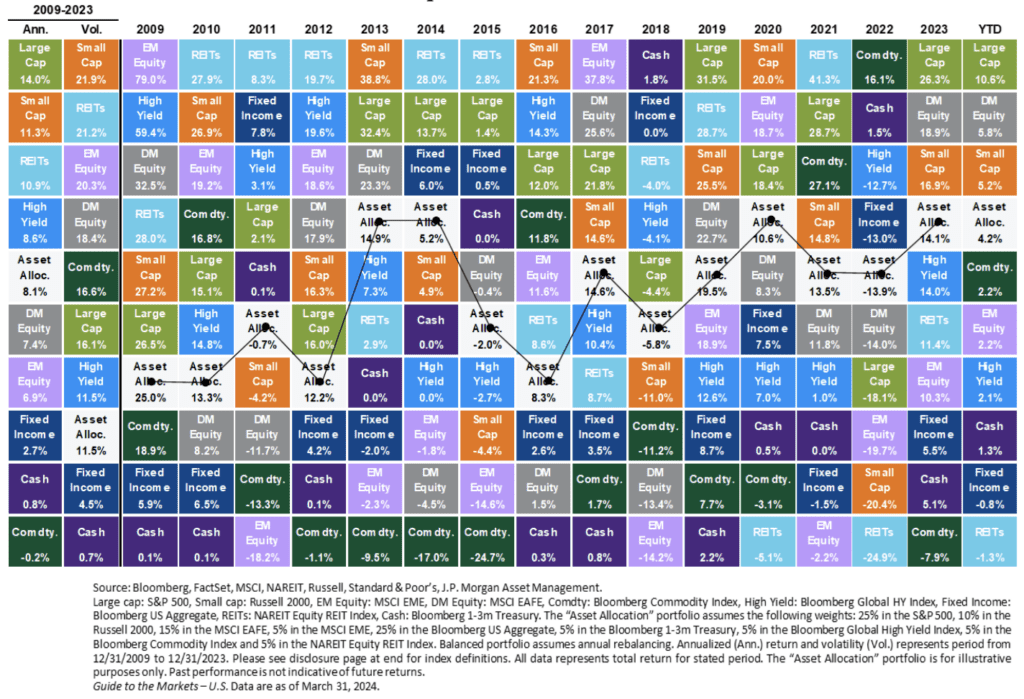

One of my favorite charts to illustrate the benefits of diversification is included below. For the time period of fifteen years shown, asset class returns are ranked year-by-year from highest to lowest from 2009 through March 31st of 2024. What is noticeable is that a “diversified portfolio” (white box labeled Asset Allocation in the chart) stays mostly in the middle of the chart and is much less volatile on an annualized basis over the entire period from 2009-2024. In fact, the Asset Allocation portfolio is the fifth best in annualized return over this fifteen-year period while also being the third least volatile.1 The “Asset Allocation” portfolio assumes the following weights: 25% in the S&P 500, 10% in the Russell 2000, 15% in the MSCI EAFE, 5% in the MSCI EME, 25% in the Bloomberg US Aggregate, 5% in the Bloomberg 1-3m Treasury, 5% in the Bloomberg Global High Yield Index, 5% in the Bloomberg Commodity Index and 5% in the NAREIT Equity REIT Index. Balanced portfolio assumes annual rebalancing. And, during the period of 2021-2024, (up 13.5% in 2021, down 13.9% in 2022, up 14.1% in 2023 and up 4.2% YTD) it was neither up as much nor down as much as the S&P 500. And this is the point.

The lesson is that there will often be periods of time when the economy, the government, society, etc. seems to be filled with “bad news.” Currently, we are experiencing the lasting effects of higher than normal inflation and the seemingly always increasing raucous election year hyperbole. Despite this, PMA believes that the best way to maintain and grow one’s financial assets is not to cash out and run for the sidelines but to remain invested. As long as an investment portfolio is built to be diversified, low cost and for the long-run it will be well positioned to overcome the inevitable short-term disruptions. This is what PMA has spent over forty years designing and implementing for our clients.

Enjoy the summer season and some rest, relaxation and fun with family and friends. We appreciate your continued trust in our stewardship of your financial assets.