Four Months or Twelve?

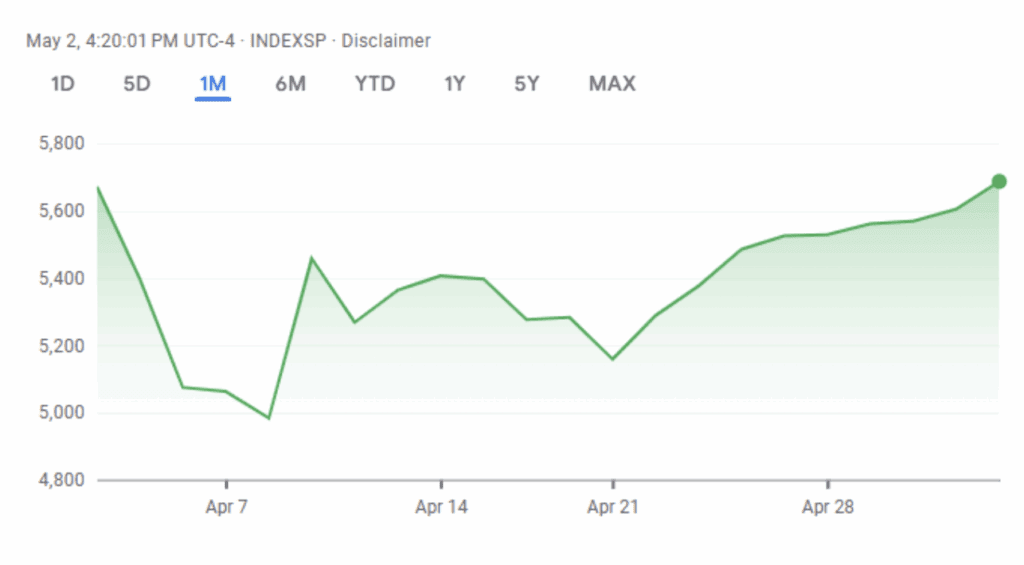

On April 2nd, just before the announcement of new tariffs on “Liberation Day,” the S&P 500 stood at 5,671. One month later, on May 2nd, it ended at 5,687. If you went to sleep on April 2nd and woke up on May 2nd, you might have thought that April was a nice, placid month in the stock market. Of course, you would have missed the 12% decline as of April 8th, and then the 8.7% increase on April 9th, and then the 5.5% drop as of April 21st, and then the 10% rise through May 2nd.

It’s been an exhausting beginning to 2025. Four months have felt like twelve. Depending on what you think about tariff policy, this volatility is all part of the “4D chess” or it is the reflection of counterproductive chaos.

This graph of the S&P 500 illustrates the recent April roller-coaster ride:

This graph of the S&P 500 shows the roller coaster from January 1st through May 2nd:

Periods like this are painful, but perhaps we can learn something from them. Here are five key lessons arising from the first four months of 2025:

1. Volatile periods are a good time to reassess your risk tolerance.

As we said to clients during the pandemic, when it comes to knowing how an investor really feels about risk, there is nothing like actually living through a sharp market downturn, just like for a soldier there is nothing like fighting an actual war. Were you able to take April’s volatility in stride, or did it cause utter terror? If the former, perhaps consider whether you could be taking more risk in your portfolio, if the latter perhaps consider taking less.

2. Every historical period is unique.

Clients have asked: “what is going to happen next in the markets” or “what do past periods of history tell us about this one” or “does the 1930s Depression offer any insight?” Looking to the past for guidance is a worthwhile exercise and can help provide perspective, but it does not provide a crystal ball into the immediate future of today’s markets.

For example, although tariffs and the great depression are often associated, the fact is that the initial market crash occurred in 1929, before the enactment of the tariffs in 1930. Therefore, while most historians agree that the tariffs of 1930 did not help the country during the great depression, they also agree that the tariffs did not cause it. The recent market decline, by contrast, was clearly caused by the April 2 tariff announcement.

Also, “the market” is nothing more than millions of investors trying to put a price on thousands of companies by projecting forward the future earnings of these companies. These earnings will be based, at least in part, on what happens with the tariffs, along with uncountable other factors. There really is no precedent, no past playbook that answers the question: “How will the future earnings of company x be affected by the continuation of the Trump tariffs, but also by the termination of the tariffs, and which outcome is the most likely?”

Every historical period is unique. Unfortunately, the future is always unknowable. While the study of history is of course critical and essential, any investor looking for a key to the markets’ future by examining historical events will inevitably be disappointed.

3. Markets are very hard to time.

Equally hard as predicting the future is timing when to get out and back into the market. If you got out of the market on March 31st, you are probably feeling pretty good about your timing. You missed a lot of stomach-churning volatility. However, given where the market is now and where it was on April 2nd, your money is about where it would have been if you had done nothing. And what about the future? How can you be confident as to when you should get back into the market?

There is a mountain of empirical, academic evidence that shows for the great majority of investors market timing is extremely difficult to get right. Market timing requires not just one perfect decision, but two – getting out of the market and getting back in both at exactly the right time.

4. Ignore most of the financial press.

Whatever their motives, whether they are really trying to be helpful or just trying to sell papers, the financial press will offer advice constantly. This advice will often be too late, too vague, not apply to your specific circumstances, and in most cases really not make much of a difference at all. In one article I read, the writer spoke with a variety of advisors who suggested moves such as adding alternative investments, moving a year’s worth of spending into cash, shifting more assets into high dividend-paying and/or infrastructure stocks, and investing in municipal bonds.

Articles like this raise more questions than they answer and often leave the reader feeling more anxious, not less. If you move into alternative investments, which ones (alternative investments is a broad category) and how much? Furthermore, with alts, their power and effectiveness depend on being invested in them before volatility increases, not after. One year’s worth of cash may be too much or too little, depending on your particular set of circumstances. Shifting money into dividend-paying stocks or infrastructure stocks may be a good move at this time, but again the question is are you too late, etc.

But all of this focus on asset allocation diverts investors’ eyes from the more important issue, especially for those in retirement who are spending from their assets, which is:

5. It’s the spending!

The longevity of your assets will not change that dramatically if you switch from 60% stocks / 40% bonds to 40% stocks / 60% bonds, or if you add a 5% allocation to commodities, or if you reduce your allocation from 20% international to 10% international, etc. What will truly help the longevity of your assets is to spend conservatively OR to spend with flexibility, meaning that you are willing and able to reduce your spending when experiencing a bad market. Evaluating your circumstances on a yearly basis, hopefully in conjunction with a meeting with your financial advisor, and adjusting where circumstances require, is truly prudent.