Diversification Redux

Peter Bernstein, investment giant, founder of The Journal of Portfolio Management (and speaker at a PMA client luncheon back in the days when luncheons could be held), famously stated that, as much as people hate it, we are “stuck with uncertainty” and that “there is only one dependable way to survive through the uncertainty of the future: diversification.”

Let’s think about that proposition by taking a quick two question quiz:

Question 1: what do Macy’s, The Hertz Corporation; Lord & Taylor, Kohl’s, H&R Block, and Helmerich & Payne (an oil and gas driller) all have in common?

Answer: each began the year as a constituent company of the S&P 500 (an index composed of 500 large companies that must, among other criteria, have a market cap of over eight billion dollars) but were subsequently thrown off because of deteriorating financial performance (indeed Hertz and Lord & Taylor, two formerly iconic brands, landed in bankruptcy court).

Question 2: while the S&P 500 index has a positive price return this year through November of 12.1%, of the 500 companies that make up the index, how many have a negative year to date return or a return less than the index return?

Answer: as of this writing, 221 of the 500 S&P companies have a negative return year to date, and 311 companies have a return less than the index return – e.g., 62% of the 500 companies have a return that is less than the index return. Extra credit point if you knew that removing technology companies from the S&P 500 index (e.g., Microsoft, Apple), reduces the index price return through November to 5.32%.

One rather obvious explanation for these results is that the coronavirus pandemic devastated the retail, travel and energy industries (hence Macy’s, Hertz, Lord & Taylor, Helmerich & Payne), while giving a substantial boost to large technology companies that were already on a multi-year winning streak.

In any event, given that 63% of the S&P 500 companies underperformed the index, an investor who sought to widely diversify her holdings amongst the largest 500 American companies in 2020 had a much better chance of a positive outcome than the investor who tried to guess which ten or so companies would far outperform the rest.

While it is true that 2020 was an extraordinary year, it is also true that even in ordinary years the rough and tumble world of American capitalism humbles giants and shows no pity to companies that stumble, no matter how famous their names might be. Once invincible seeming Companies brought to heel and in recent years kicked off the Dow Jones Index – an exclusive Index of only 30 large successful companies – include General Electric, Exxon-Mobil, Pfizer, AT&T and General Motors. Conversely, Apple did not join the Dow until 2015 while Amazon and Google are still excluded from it.

A 2014 study by JP Morgan, titled “The Agony and the Ecstasy: The Risks and Rewards of a Concentrated Stock Position,” made a similar point (the rather strained title is cribbed from a 1961 novelization of the life of Michelangelo). This study examined the returns of companies in the Russell 3000 Index at any time from 1980 to 2014, a database of 13,000 companies (the index tracks the performance of 98% of all U.S. publicly traded companies). The Study found that during these 34 years two out of every five companies on the Index lost at least 70% of their value and never recovered over this period. That’s 5200 companies effectively failing.

Furthermore, the Study found that most of the Index’s return over this period came from only 7% of constituent companies that substantially outperformed the rest. That’s only 910 companies out of the 13,000. In other words, missing out on owning a small percentage of “extreme winners” through time would have been extremely harmful for an investor’s return.

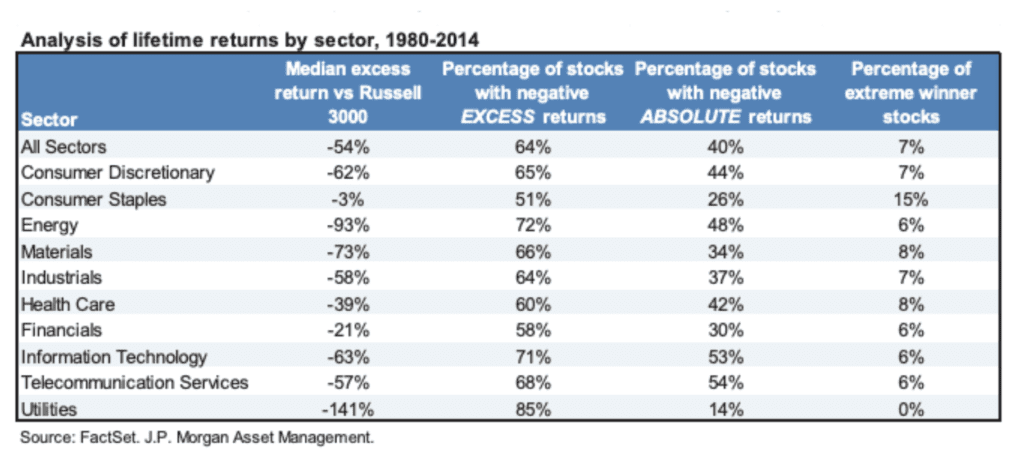

The following chart from this Study further illustrates that when looked at from a sector perspective: (a) in every sector more stocks had negative excess returns compared to the overall index than positive; (b) in most sectors around 40-50% of stocks had negative absolute returns; and (c) the percentage of extreme winner stocks in all but one sectors was between 6 and 15%.

In short, according to this Study, “continued concentration may ultimately destroy wealth.”

These diversification principles, of course, were built into the “DNA” of Prudent Management Associates at its founding. Indeed, PMA’s decision in 1982 to exclusively use no load mutual funds – which at that time were a somewhat novel and under-used security – to build risk adjusted portfolios for clients, was partially based on the recognition that the mutual fund is an excellent vehicle for achieving diversification of holdings. Because one mutual fund can own hundreds or thousands of companies, diversification in a particular area of the market can be achieved or partially achieved through the purchase of just one security. For example, the Vanguard Total International Stock Index Fund, owned in the International sleeve of most PMA portfolios, invests in over 5000 stocks issued by companies located in 46 countries, primarily in Europe and Asia. Through owning just this one mutual fund, PMA clients get a broad and diversified exposure to international companies, such as Alibaba Group Holding, Taiwan Semiconductor, Nestle SA, Toyota and Samsung Electronics, among 1000s of others.

PMA seeks further diversification for its clients by building portfolios with mutual funds that target specific segments of the marketplace. In other words, PMA expends significant effort to find high quality mutual funds that focus on either small, midsize or large companies, and that focus on companies that are either growing quickly or that are seemingly undervalued. An essential part of PMA’s due diligence process is ensuring that the mutual funds it selects “stay in their lane” and focus on their stated mission, whether it is midsize value companies or large international ones etc. For most PMA clients, portfolios are diversified at the highest level through the introduction of fixed income securities, bonds, in addition to equities. Within the fixed income sleeve, diversification is primarily achieved through a mix of short maturity and intermediate maturity funds, the majority of which focus on investing in high quality bonds.

Through this process a PMA portfolio represents not a bundle of randomly selected securities, but a cohesive whole designed to achieve maximum diversification and risk mitigation.

When Peter Bernstein stated that the only way to “survive through the uncertainty of the future” was diversification, he likely had in mind as support for this proposition studies from academic finance that provided a mathematical basis for it. This wisdom, however, has long been recognized – indeed Ecclesiastes 11:2 advised those with property to “Divide a portion into seven, yea, even into eight; For thou knowest not what evil shall be upon the earth.” Or, as Shakespeare’s Merchant puts it, “My ventures are not in one bottom trusted, Nor to one place; nor is my whole estate Upon the fortune of this present year.”

Another tenant of PMA is that predictions about future events are doomed to fail, but I will go out on a limb and make this prediction – diversification will always be a central principle underlying PMA’s investment philosophy.