Bright Returns under Cloudy Skies

I recently returned from a summer vacation feeling rested and recharged. I hope that you and your family were able to enjoy peace and happiness this summer. As I was sitting outside one day with my family on a beautiful afternoon, I happened to look up at the sky and noticed how cloudy it was. It was surprising, because I felt the sun’s warmth, but all I saw was cloud cover—it seemed like a perfect metaphor for how this year has gone in the markets.

Had I written in January 2025 and predicted in the next eight months a new war between Israel/Iran, the highest level of effective tariffs levied since the early 1900s, and stubborn inflation, I certainly would not have assumed the strong returns that investors in a balanced portfolio have earned to date—this is the surprising warmth that we are feeling today under the cloudy investment landscape overhead, described further below.

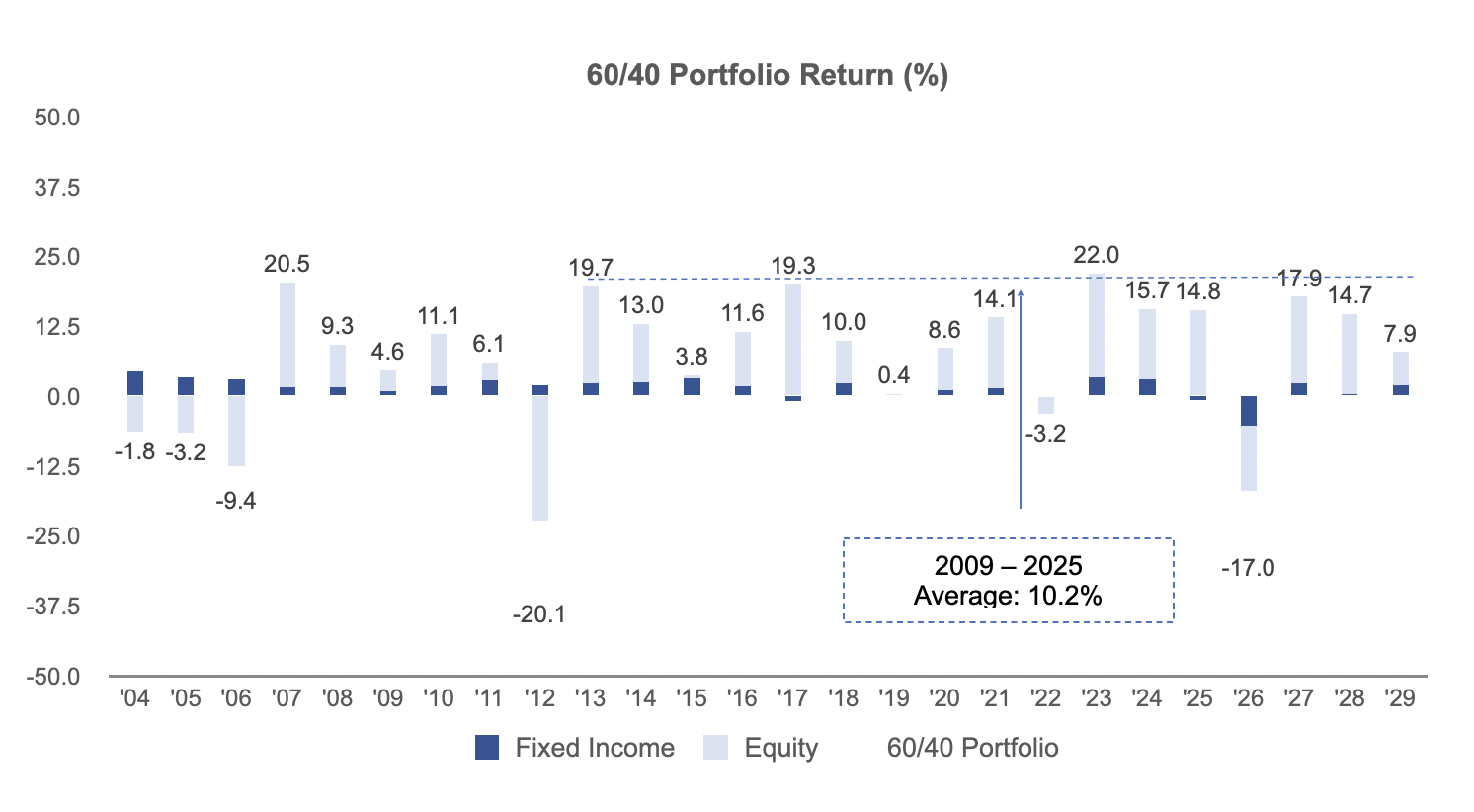

Refer to the following chart, which decomposes the returns of a 60/40 equity/fixed income portfolio. This portfolio is comprised of one broad stock fund (returns indicated in light blue) and one broad bond fund (returns indicated in dark blue). The number at the top or bottom of each bar is each calendar year’s total return for the aggregate portfolio.

A few things jump out from this figure. First, it is clear that since the Global Financial Crisis of 2008-2009, we have been living in a very healthy return environment for US stocks and bonds. Since 2009, and inclusive of 2025 year-to-date, the average calendar year return for this particular 60/40 portfolio has been 10.2% (well above longer-term historical averages). We have only experienced two calendar years with negative total returns, though in a few of these up-market years we lived through violent intra-year drawdowns (i.e., March 2020 and April 2025).

Notes: PMA calculations, using data from Morningstar. The “Equity” component in the figure above is represented by the Vanguard Total Stock Market Index Fund (Admiral). The “Fixed Income” component in the figure above is represented by the Vanguard Total Bond Market Index Fund (Admiral). The 2025 calendar year return is a year-to-date figure as of August 25, 2025. The hypothetical portfolio is rebalanced annually.

Notes: PMA calculations, using data from Morningstar. The “Equity” component in the figure above is represented by the Vanguard Total Stock Market Index Fund (Admiral). The “Fixed Income” component in the figure above is represented by the Vanguard Total Bond Market Index Fund (Admiral). The 2025 calendar year return is a year-to-date figure as of August 25, 2025. The hypothetical portfolio is rebalanced annually.

The last seven years from 2019 through 2025 year-to-date have been even more generous, returning 10.9% even with 2022’s very poor return dragging down the average. And that brings us to 2025. Even with all of the uncertainty in the macroeconomic backdrop, this broad portfolio consisting of 60% US equities and 40% US fixed income has returned about 7.9% through mid-August.

Now, there are good reasons for why US equities and fixed income have delivered healthy returns this year, as my colleague Professor Craig MacKinlay covered in his last memo. Namely, the US economy and corporations have held up surprisingly well under pressure from a restrictive federal funds rate and a historic barrage of tariffs. Inflation, though starting to move in the wrong direction, has fallen markedly from 2022 highs and the labor market remains relatively strong (though cracks are emerging). With that said, while market results this year have been positive, a few key risks on the horizon include: US trade policy, equity valuations, and budget deficits.

With respect to trade policy, there is still a wide variation in potential outcomes, ranging from tariffs being struck down via the federal courts to the levies being further ratcheted up via other legal authorities. It appears that the impact of tariffs on US corporations thus far has been mitigated by a combination of businesses: (1) frontrunning them by ordering excess inventory earlier this year and; (2) absorbing significant portions of them to avoid losing price-sensitive customers battered by the recent bout of high inflation. Whether US business will be willing to offset their impact over a longer period of time is questionable.

US equity valuations appear fairly stretched after this year’s rapid recovery from April’s “Liberation Day” lows. Though rising valuations suggest lower future returns over the longer-term—in other words, lower future returns than the S&P 500’s 14.7% annualized return from January 2009 through July 2025—they do not provide meaningful insight into short-term market performance. Nonetheless, equity valuations are an important input into our investment decision-making process. Relatedly, the top ten stocks in the S&P 500 Index (which are predominantly mega-cap technology companies) make up roughly 40% of the Index’s market capitalization at present—this is a historically significant degree of concentration in the US equity market and bears watching moving forward.

Finally, US budget deficits are too large, and both political parties seem unwilling to take meaningful action to address this problem. Though investors have been paying closer attention to the US’s finances this year (similar to the situation in 2011 when the US’s credit rating was first downgraded by Standard & Poors), it is virtually impossible to predict precisely when our growing national debt will become a major market problem. All else equal, continued US government borrowing should keep interest rates higher, with a variety of implications for the US economy and asset prices.

In response to these and other factors, PMA has made modest defensive adjustments to its asset allocation policy over the course of this year, consistent with our more conservative investment approach. These include: (1) reducing the allocation to US small-cap companies in our equity allocations; (2) keeping a fairly short-maturity-biased and high credit-quality profile in our fixed income allocations; and (3) maintaining a modest underweight to US mega-cap technology stocks to improve the diversification profile of our US equity sleeve (and due to their stretched valuations).

I recently celebrated my six-year anniversary with PMA, and what I have come to truly embrace through my time at the firm is that investing is never without risk, because risk is what ultimately yields the returns we investors hope to achieve in the future. If you would like to discuss our thoughts on the markets or our current portfolio positioning, as always, please do not hesitate to contact your advisor.