A Strange Recession and Bear Markets

The television and newspapers are blaring the word “recession” with increasing frequency, for good reason. As Craig MacKinlay noted last month, based upon one economic rule-of-thumb, the United States is currently experiencing one. In this month’s letter, I want to explore the concept of a recession in greater detail. More specifically, I will take a broad perspective in assessing the economy and how it relates to outcomes in the public markets, which are interconnected but also maintain important differences.

A recession is commonly defined as two successive quarters of declining GDP (or Gross Domestic Product, which is the aggregate value of goods and services produced by an economy). Changes in GDP are often quoted in “real”, or inflation-adjusted, terms and are presented as annualized rates. In Q1 2022, US GDP declined by 1.6% and in Q2 2022, US GDP declined by 0.6%. In the US, recessions are actually determined by the National Bureau of Economic Research, which classifies them on a historical basis as a “significant decline in economic activity that is spread across the economy and lasts more than a few months.” 1 For additional information, see: https://www.nber.org/research/business-cycle-dating/business-cycle-dating-procedure-frequently-asked-questions. In making the determination of a recession, the Committee reviews the depth, diffusion, and duration of declines in economic activity, across many key macroeconomic indicators. Regardless of what definition is used, when anyone speaks about recessions, they are ultimately discussing major slowdowns in economic activity.

Since World War II, the US has experienced twelve recessions. Each of these periods has been unique and challenging in its own right. That of 2020, still particularly fresh in our minds, was extremely painful in terms of reductions in economic activity though quite short in duration. In examining the data, one important commonality generally occurs across each recessionary period—a material increase in the unemployment rate. One of the worst aspects of a recession is job losses, which create major disruptions for those affected with ripple effects well into the future.

What is particularly odd about our current situation in 2022 is that the labor market is still extremely strong. In July, the economy added 528,000 jobs and the unemployment rate dropped to 3.5%. In fact, with July’s payroll additions, our economy has now recouped the total number of jobs lost in 2020.

There are a variety of factors affecting the current state of the labor market, including a significant number of retirements by older workers pulled forward by the pandemic. How the labor market evolves as a result of continued monetary policy tightening by the Federal Reserve certainly bears watching, as the US has never experienced an official recession with an unemployment rate below 6.1%. To succinctly sum up, as one Wall Street Journal July 4 headline stated, “If the U.S. Is in a Recession, It’s a Very Strange One.” 2 See: https://www.wsj.com/articles/recession-economy-unemployment-jobs-11656947596.

In comparing the stock market to the economy though, it is helpful to consider each as distinct, though overlapping, entities. More specifically, by market-capitalization, the US stock market is dominated by large corporations, which represent approximately 70% of its total value. At present, large technology firms like Apple, Microsoft, and Google are a significant percentage of the market (these three firms alone comprised approximately 14% as of the end of July). The US economy, on the other hand, is far broader than what is reflected in the public markets alone. Take private small businesses, absent from broad US stock market indexes, and which drive a significant share of our economic activity—they create roughly two-thirds of net new jobs and account for approximately 40% of GDP by one estimate. 3 See: https://advocacy.sba.gov/2019/01/30/small-businesses-generate-44-percent-of-u-s-economic-activity/. This juxtaposition alone highlights how different the US stock market is from the broader economy.

One further distinction between the two is that economic data points such as GDP readings and payroll reports represent current-state snapshots. They describe to us the health of our economy as it is now—a recession means that our economy is currently under duress at present. The markets, however, are forward-looking in nature. For example, a stock’s price can be thought of as the sum of the future stream of cash flows it will generate for investors, discounted back to the present. To simplify: what ultimately moves a public company’s share price, and the market in general, is information that relates to future expectations. For example, the release of a negative GDP reading that already represents investors’ consensus expectations should not materially impact market prices in isolation.

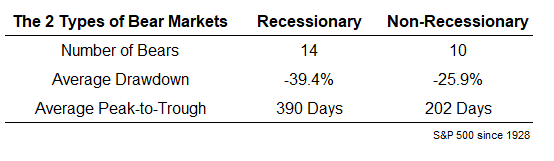

From an investor’s perspective, connecting the implications of a recession to the markets is of importance. Recessions often do coincide with bear markets (a decline of 20% or more from a recent market peak), or at minimum, equity market drawdowns of significant magnitude. This is intuitive, as major slowdowns in economic activity affect corporate revenues and earnings. But not all recessions are associated with a bear market, and not all bear markets are associated with a recession. Of note, historically in the US, bear markets that coincide with recessions have tended to be more severe—on average, the market has declined by approximately 14% more when a bear market is tethered to an official recession. The statistics in the table below are presented for the S&P 500 Index dating back to 1928.

Source: The 2 Types of Bear Markets. Ben Carlson. A Wealth of Common Sense. May 12, 2022. https://awealthofcommonsense.com/2022/05/the-2-types-of-bear-markets/.

Source: The 2 Types of Bear Markets. Ben Carlson. A Wealth of Common Sense. May 12, 2022. https://awealthofcommonsense.com/2022/05/the-2-types-of-bear-markets/.

At face value, these numbers make sense. A sharp drop in economic activity most certainly will have a major impact on the public companies that comprise the stock market. The S&P 500 has already experienced a decline of over 20% this year, though subsequently rallied in July as a result of signs pointing to easing inflation pressures (amongst other things). Nonetheless, in looking ahead, the implication is clear: should economic activity continue to slow, perhaps as a result of increasing interest rates or other factors, and should the job market begin to weaken—ultimately leading to a deeper recession—history suggests that more market declines lie ahead. On the other hand, should the Federal Reserve bring down inflation without triggering a more protracted recession, we may have already lived through most of the worst of this current drawdown. We certainly hope the latter scenario proves to be the case, but the possibility of the former is very real.

Nonetheless, even if unemployment increases, making this potential recession more in line with past experience and less “strange,” every period in market history is unique, and past recessions have not always been associated with severe market outcomes. For example, Ben Carlson notes: “The [recessionary] bear markets in 1990, 1980-1982, 1961-1962, 1957 and 1948-1949 were all losses of less than 30%. It is possible to have a recession that leads to a relatively minor bear market.” For what it is worth, as I write this memo, some market indicators are predicting that the Federal Reserve can tame inflation by taking a less aggressive path with the federal funds rate (and even cutting it more quickly) than what is currently being suggested via public comments and meeting minutes. 4 See: https://www.wsj.com/articles/five-not-quite-impossible-things-the-market-believes-11660655208. This is reflective of the more optimistic scenario for the economy described above. However, though a relevant data point, the market’s consensus expectations are not always a reliable forecaster, particularly on the short-term direction of interest rates.

PMA monitors many key macroeconomic variables, but we do not attempt to time the short-term direction of the markets to opportunistically add value. We do not believe that this type of strategy can be consistently executed through time. Instead, we prefer to take a longer-term approach in managing our clients’ portfolios. Whether the US is officially declared to be in a recession in the near future matters less to us than the potential further depth of decline in US economic activity. We hope the current outlook will improve from here, and we are carefully monitoring data related to the health of the economy, inflation, and the conflict between Russia and Ukraine. As always, we will continue to make portfolio adjustments as necessary based on our Investment Committee’s overall assessment of risk in the markets and our long-term investment strategy.