About Us

Prudent Advice for Prudent Investors. Since 1982, Prudent Management Associates has served the needs of high-net-worth individuals, small- to medium-sized businesses, and all types of not-for-profit institutions. We have done so using a “manager-of-managers” investment program to create customized, diversified portfolios for our clients. PMA’s Investment Committee – advised by A. Craig MacKinlay, the Joseph P. Wargrove Professor of Finance at The Wharton School—selects the funds and fund managers for our clients’ portfolios and reviews their performance regularly. Our goal is to reduce portfolio volatility while producing superior risk-adjusted returns.

Core Values

Consistent Returns and “Clients First.” For over 40 years, PMA has envisioned a better, more prudent approach to investing: one focused on minimizing risk over time – not chasing short-term returns — to achieve consistent, reliable long-term gains. Every person on our staff is instilled with the PMA value of putting our clients first.

Although this is a business relationship, for PMA it’s also a personal relationship. We pride ourselves on being able to offer a level of attention that larger firms simply can’t.

Our History

In 1982, Philadelphia attorney Ed Snitzer met Marshall Blume, PhD, a finance professor at The Wharton School — later chair of the Finance Department — and outlined an idea he had for an innovative approach to investing. Marshall agreed and, with that, Prudent Management Associates was born.

The essence of their idea was that, instead of predicting short-term future returns, they would seek to control risk by using no-load mutual funds to achieve diversification. Each mutual fund invests in a group of carefully selected securities, thereby reducing risk within the fund. Ed and Marshall sought further diversification by selecting a wide variety of funds, each of which was typically concentrated on one segment of the market. They then used these funds to construct a risk-controlled portfolio tailored for each individual client.

Although PMA has made adjustments to our methodology over the years, we have remained true to these core principles because they have served our clients well.

Marshall Blume and Ed Snitzer’s legacy lives on in the “DNA” of PMA today. PMA’s disciplined approach to investing and our decades-long relationships with clients — including multiple generations in some families – continues through Fred D. Snitzer and Paul D. Snitzer, who have been with the firm since 2002 and 2011, respectively, and are now leading PMA.

Expert Connections

PMA’s prominence within the investment community has enabled us to welcome many distinguished speakers to our client events, including:

Theodore R. Aronson, founder of AJO and a lecturer in finance at The Wharton School

Peter L. Bernstein, economic historian, first editor of The Journal of Portfolio Management, and author of several best-selling books on economics and finance, including Against the Gods: The Remarkable Story of Risk and Capital Ideas: The Improbable Origins of Wall Street

John Brennan, former CEO and chairman of the board at Vanguard

Tyler Cowen, noted economist and professor at George Mason University, director of the Mercatus Center, author of the New York Times best-seller The Great Stagnation and other books, and blogger at MarginalRevolution.com

Charles D. Ellis, former managing partner of Greenwich Associates, a strategic consulting firm that served leading financial service organizations, and the author of 12 books on investing, including Winning the Loser’s Game

John B. Neff, an investor and mutual fund manager known for heading Vanguard’s Windsor Fund

Brian C. Rogers, former chairman and chief investment officer, T. Rowe Price

Robert Shiller, Sterling Professor of Economics at Yale University and joint winner of the 2013 Nobel Prize in Economic Sciences, also known for many books including Irrational Exuberance

Jeremy Siegel, the Russell E. Palmer Professor of Finance at The Wharton School, winner of multiple awards for his teaching and research, and author of the groundbreaking Stocks for the Long Run and The Future for Investors

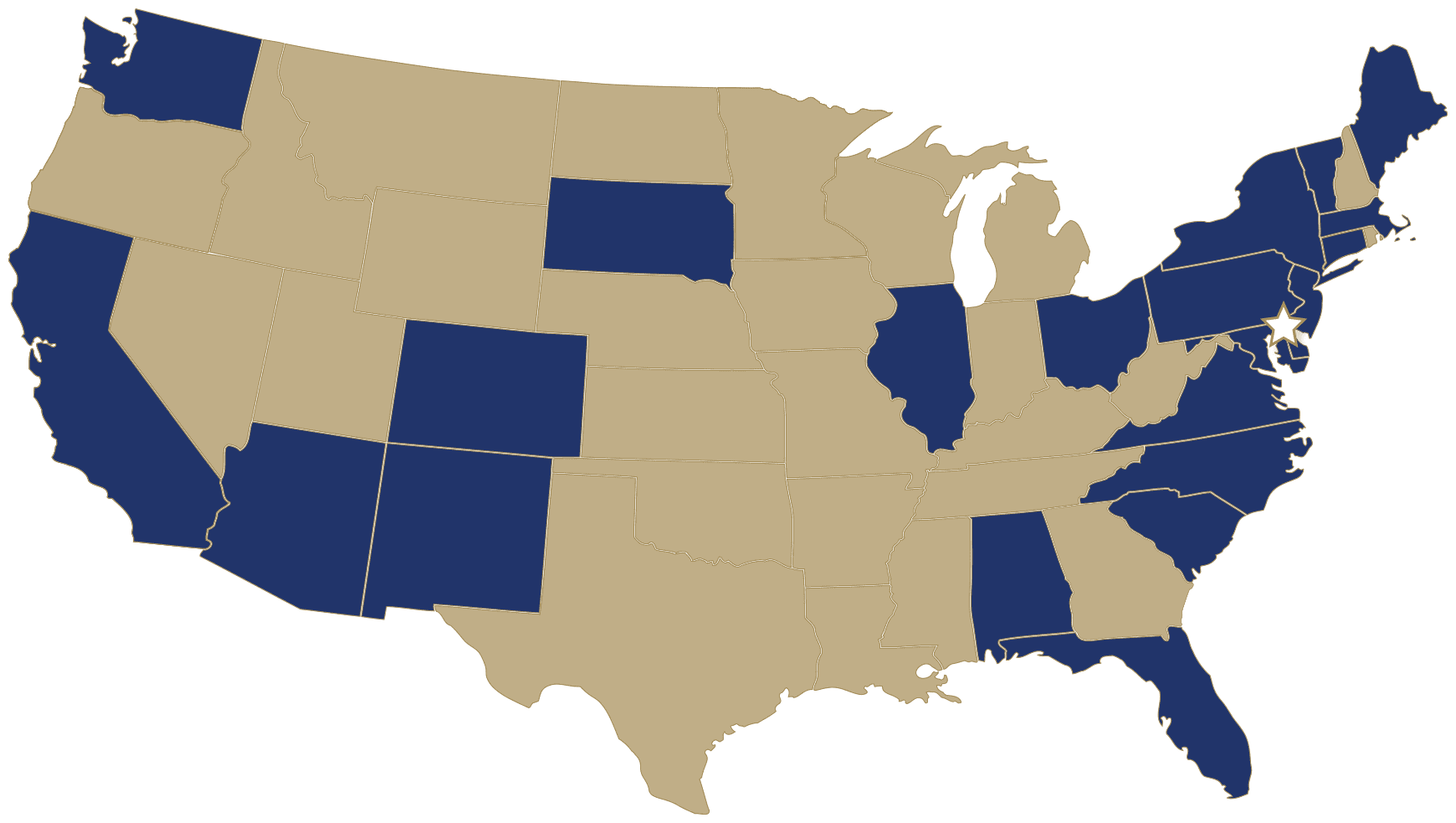

PMA’s Reach

As of June 2022

PMA clients are located in every region of the United States and are serviced by our team in the Philadelphia office.

“I put all of my trust into the hands of PMA 30+ years ago and I would not be in the position I am today if it wasn’t for their guidance and exceptional service. It brings tears to my eyes when I think of all the wonderful ways the Snitzer family and PMA have helped me.”

“MS”, PMA Client Since 2001, Elkins Park PA